In recent years, Spain has become an extremely attractive destination for Latin American investors seeking opportunities in the luxury real estate market. The following report aims to analyze the cross-border investment landscape in luxury real estate in Spain in recent months, focusing on the growing interest of Latin American investors.

Current situation of the Spanish real estate market:

The Spanish real estate market has experienced a remarkable recovery in recent years. After the economic crisis of 2008, the real estate sector has shown signs of steady growth, especially in the luxury real estate segment. Cities such as Madrid, Barcelona, Costa del Sol, Ibiza and Mallorca have stood out as attractive destinations for foreign investors, including Latin Americans.

Data from idealista indicate that last July, average housing prices in Spain increased by 7.2%, despite estimates of a slowdown in property purchases during 2023. On the other hand, in the midst of so many changes in the real estate market in Spain, foreign buyers are breaking sales records. According to the Registrars, in 2022 they accounted for 13.8% of transactions, the highest figure in the entire historical series.

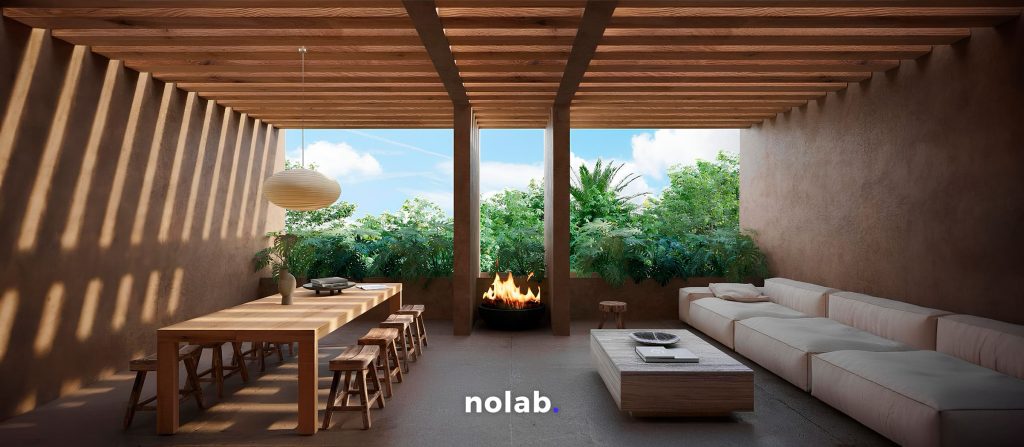

The Spanish real estate market offers a wide variety of luxury properties, from villas and apartments in prime locations to historic estates and coastal properties. In addition, the country has a solid infrastructure, an excellent quality of life and a strategic location within Europe, making it a popular destination for cross-border investment.

Where do foreigners buying property in Spain come from?

Hiscox data indicate that foreign buyers come mainly from the following places:

- United Kingdom

- Germany

- France

- LATAM

- Russia

- China

The most interesting properties for this buyer profile are located in coastal areas of the country, with the Costa del Sol being one of the most desirable places for foreign buyers to invest and live.

Why is Spain such an attractive country for cross-border real estate investment?

Spain is a highly attractive country for cross border real estate investment due to a number of factors that capture the attention of international investors. First, its privileged geographical location provides exceptional diversity, with spectacular beaches, vibrant cities and charming rural villages. In addition, its mild and sunny Mediterranean climate for much of the year makes it an ideal destination for those seeking a relaxed lifestyle and outdoor enjoyment. This combination of natural attractions and picturesque landscapes is especially attractive to investors seeking properties for tourism and vacation rentals.

Another aspect that makes Spain an attractive destination for real estate investment is its solid infrastructure and services, which guarantees an excellent quality of life for residents and tourists alike. Data from the Spanish Association of Registrars indicates that foreign investment accounts for 8% of sales in Barcelona and during 2021 property sales and purchases in Spain increased by 38.1% reaching 676,775 units.

Spain has a rich history and tradition, offering a wide range of cultural and leisure activities to enjoy. The Spanish real estate market also offers competitive prices compared to other European countries, which represents an attractive opportunity for investors looking to obtain a good return on their investment.

Despite the challenges caused by Brexit and the Covid-19 pandemic, foreign interest in Spain’s real estate market has remained strong, and a significant increase in home sales is expected in the country’s tourist regions, driven largely by foreign buyers.

What are the key trends in cross-border real estate transactions?

According to the perspective of Daniel Obregón, CEO at Nolabsome of the main trends that have boosted the interest in real estate investments in Spain by foreigners are:

- Increased investment by the millennial generation and the need for access to a better quality of life by digital nomads in some of the most desirable cities to live in. most desirable cities to live in.

- Growth in foreign investors’ interest in investing in the vacation rental markets in historic and paradisiacal destinations.

- Growing popularity of secondhome destinations.

- Increased demand for green, sustainable and socially responsible properties.

- Adoption of technology to facilitate secure cross-border transactions.

- Nearshoring The outsourcing of company production to new countries has triggered a demand for new housing for foreigners.

Benefits and considerations of cross-border investment:

Acquiring a residence in Spain as a foreigner offers a number of attractive benefits. First, the country has a legal framework that allows foreigners to buy property without restrictions, which greatly facilitates the process. On the other hand, Spain has a solid property rights protection system, which provides security and peace of mind to investors.

Daniel Obregón leads the paradigm shift in cross border transactions at Nolab, and identifies important benefits for Latin American investors interested in expanding their investment portfolio with cross border transactions.

“Our vision is to transform real estate investing into a borderless experience, providing exceptional opportunities for people from anywhere in the world,” Obregón stresses.

The rental housing market is currently on the rise, both for long-term and vacation rentals, providing the opportunity for attractive returns. Data from the Spanish Rental Insurance Observatory (OESA) indicates that in 2023 the growth of rental properties in Spain was 5.8%, and is expected to grow to 6.5% by the end of 2023.

For Obregón, identifying areas of opportunity in the investment process has allowed them to find a niche with a lot of potential; “firstly, we believe in education as a catalyst for informed decisions, secondly, our digital platform connects buyers and sellers efficiently, backed by analytical tools that empower sound decisions. As an impartial intermediary, we ensure that transactions are secure and fair.

Finally, our full-service offerings range from property management to specialized legal advice. We created a network of trusted local professionals to support investors at every stage.”

Some of the main benefits for foreign investors:

- Quality of life and low cost of living: Spain’s geographical location and year-round climate are two decisive factors for investors looking for a home in the country. In the Costa del Sol, located in the southwest of Spain, foreigners have found an idyllic setting for real estate investment thanks to the sunny climate that prevails here almost all year round, also, the quiet quality of life and the Mediterranean cultural encounter that has developed historically, make the Costa del Sol a highly attractive destination for tourism worldwide.

- Return on investment potential: Whether through capital appreciation, leasing or flipping a property in Spain, the return on investment is highly attractive for an investor profile looking to diversify their portfolio. According to data from Idealista, the capital gains in some of the most desirable neighborhoods to live in Madrid, such as Retiro, Chamberí, Ibiza or Centro, range between 10% and 29% per year. On the other hand, the average rent of a luxury property in Madrid is between 5,000 €.

- Golden Visa: Another benefit to take into account is the possibility of obtaining a residence in Spain through the acquisition of a property. The process is known as Golden Visa and allows foreigners and their families to reside in Spain and travel freely throughout the European Union. This option is especially attractive for those who wish to establish a second residence or take advantage of business opportunities in the country. It is important to note that, in addition to the appreciation in value, investing in real estate in Spain can generate attractive income through the rental of the property.

Cultural barriers to overcome for Cross Border investment success

While financial factors are central to cross-border investment, cultural differences play an important role in consolidating successful moves into the Spanish real estate market.

- Language: Although much of Latin America and Spain share Spanish as their primary language, effective communication can be hampered by differences in linguistic structures, tones and particular colloquialisms. To overcome this challenge, it is advisable to have a team of experts who are natively fluent in the local language nuances . Their experience and cultural knowledge will help to avoid misunderstandings and ensure a successful negotiation in the field of cross-border real estate investments.

- Culture and tradition: Each country has its unique set of traditions, customs and behaviors that influence the way business relationships are built. To achieve success in negotiation, it is important to respect basic concepts such as greetings, farewells and small talks. In addition, you should be flexible and respectful of local customs, be punctual for all agreed meetings and show a formal attitude to foster good personal relationships. Again, in this scenario it is vital to have a local partner that understands the cultural nuances and protects the interests of foreign investors in order to achieve a smooth and successful process.

- Local regulations: Local regulations and laws represent another important challenge for cross-border investors. Each country has its own regulations and legal requirements regarding foreign investments, which can be complex and vary significantly from place to place.

When buying a property in Spain it is important to check aspects such as the ownership and encumbrances of the property directly at the Public Registry of Property. On the other hand, as an investor, you must take into account compliance with urban planning and construction regulations. For example, in the center of Madrid it is strictly forbidden to change the facades of historic buildings or alter them in any way.

Overcoming these challenges is simple by having local real estate experts who are familiar with the regulations and can provide expert advice. Did you know that a home in Spain can have a mortgage burden of up to 40 years? If proper legal checks are not performed a buyer may inherit this debt for several years or decades.

How is it possible to mitigate risks in cross border real estate investment?

According to Daniel Obregón’s experience in these types of cross-border transactions, he shares the following: “One of the keys to success lies in seeking out and collaborating with allies in unfamiliar terrain. Our compass for moving forward with confidence is local legal and financial advice. It is through them that, with their advice, we shield ourselves against the various loopholes in the different regulations and minimize potential risks.

At Nolab we are fully aware of the importance of data and technology, that is why our platform allows solid and reliable operations, creating secure bridges for our users’ transactions. We are also committed to information security and much of our efforts are aimed at ensuring the privacy of all parties involved.”

How to buy a property in Spain as a foreigner?

What should you know before investing in real estate in Spain as a foreigner? Although each case is different, the following is a list of essential points to consider when investing safely in cross border real estate.

- Market research: Although there are constant factors in the Spanish real estate market, it is worth investigating the trends of the last months to establish parameters in the property search, for example; location, type (house or apartment), purpose of the property, yields and the time that the whole purchase process may take.

- Establishing a budget: Determining financial capacity is key to understanding what type of properties to pay attention to. Remember that you can arrange a mortgage loan in Spain from Mexico through an experienced advisor.

- Legal and financial advice: In the particular case of Mexico and Spain we find similar factors in the purchase and sale of a property, however, it is a reality that there are completely different aspects that can stop the investment. It is essential to have the support of a lawyer specialized in international real estate transactions throughout the purchase process.

- Understand the purpose of the property: What is the potential of the property? Are you interested in moving directly into it, would you like to rent it out, or do you simply want to make a profit by renovating the property? Once you are clear on this point, it will be easier to choose the type of project that fits your budget and objectives.

- Property improvements: the previous point will give you clarity to understand what improvements you should make to the property and how much extra you should invest for the process.

- Property Management: If you decide to rent the property, consider hiring the services of a property management company to manage the rental and maintenance of the property.