Contenido de este artículo 🧭

ToggleHistorically, the change of government in Mexico implies a series of transformations in many areas of daily life: from social factors, security, environmental and energy policies. In the case of the financial sector in particular, this change often involves the awakening of uncertainty among hundreds or thousands of investors in the country given the new ways of acting with respect to economic and legislative regulations. Therefore, it is worth asking the following question: Will the change of government in Mexico bring continuity or change for Mexican investors? In this article we will explore some of the main concerns for investors in Mexico in this new year 2024, as well as the attractiveness of markets beyond the borders, in the particular case of the real estate sector in Spain.

Main uncertainties for Mexican real estate investors

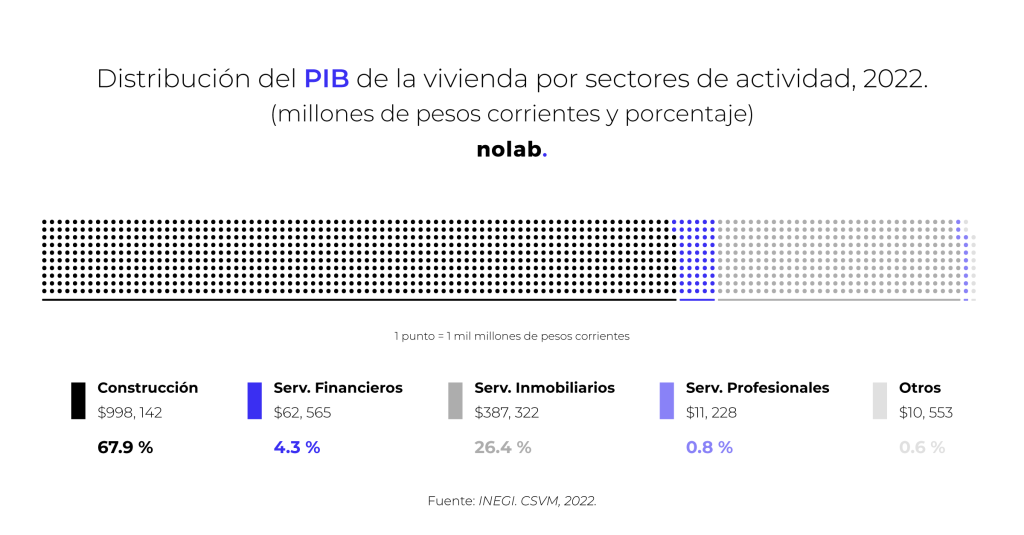

The governmental changes that occur every six years, together with the associated administrative transformations, have generated significant concerns for investors in the real estate sector. This outlook is especially worrisome if we consider that, according to data from the Bank of Mexico, the real estate market in Mexico contributes more than 14% of the national Gross Domestic Product.

On the other hand, in one of the latest surveys conducted by the consulting firm KPGM regarding the uncertainty of Mexican investors with the change of government, revealed that 58% of the executives surveyed for the study believe that the change in the federal administration will have the greatest impact on their operations, which has raised concerns about the economy and the way they do business. This could result in a potential slowdown and flight of investment in Mexico.

While the real estate industry represents one of the most important economic pillars in Mexico according to INEGI’s outlook, it is not out of place for Mexican investors to look beyond the borders. For example, the Spanish real estate market is showing interesting growth in Spanish destinations such as Madrid and the Costa del Sol, offering investment opportunities that can provide stability and diversification to your portfolio.

Undoubtedly, one of the most alarming challenges for investors in Mexico is the rule of law and persistent insecurity. Almost half of the executives surveyed identified these as the most pressing risks for companies in the country. Uncertainty surrounding governance and legal certainty raises questions about the business environment and the long-term viability of investments. In any type of investment in Mexico, a constant for success is the confidence that one can have in the country’s financial and political landscape. Therefore, it is natural that a change of government brings with it doubts regarding policies for managing projects on national territory.

On the other hand, political polarization, social protests and the general dissatisfaction perceived in the Mexican middle class also generate concern among investors, as these factors may impact the country’s political and economic stability in the medium and long term. In addition, government policies regarding the relationship with the private sector and the implementation of reforms, such as the energy and tax reforms, may influence investors’ perception of risk.

Spanish real estate market: the jewel in Europe’s real estate crown?

Given the uncertainty of the administrative change that will occur in 2024, many Mexican investors are considering new options to safeguard their assets, and the Spanish real estate market is emerging as an attractive alternative. Destinations such as Madrid offer a unique combination of factors that make them prime locations for property acquisition, as Spain offers a solid legal framework, transparency in transactions and protection against corruption, factors that provide security for foreign investors.

Spain offers an incredible diversity of real estate offerings

The innovative architectural proposal that combines the most charming of a traditional style with the functionality of avant-garde trends, make Madrid an incredible destination for investment and living in all of Europe. Here you will find a residential proposal ranging from luxury residential apartments to offices, commercial premises and hotels. This diversity of offerings allows investors to tailor their investment decisions to their specific needs and objectives, whether seeking rental income, long-term capital appreciation or a combination of both. With competitive prices and a solid growth outlook, Madrid’s real estate market offers opportunities for investors of all profiles and budgets.

On the other hand, The Costa del Sol and strategic points such as Malaga and Marbella, represent the best of a life on the coast with the performance of the best cities in the world. Spain’s coastline facing the Mediterranean Sea is internationally renowned The city, with its cultural and gastronomic offerings and Mediterranean climate, presents a solid asset diversification opportunity in the real estate market. In addition to being a renowned tourist destination, the city offers stability in terms of infrastructure, quality healthcare and low crime rates. This combination of factors creates an environment conducive to long-term investment, attracting investors seeking stability and sustainable growth in their portfolios.

Cities such as Malaga, Marbella, Estepona, Alicante, Valencia, and others, are positioned as destinations with great potential for real estate investment in Europe, a phenomenon driven especially by the fact that they are destinations in constant expansion, which in turn implies a boost in business, cultural and leisure development in the area. As a result, the demand for both residential and investment properties continues to increase.

But isn’t Spain experiencing uncertainty similar to that of Mexico for real estate investors?

Spain has a stable and transparent legal system that protects the rights of both domestic and foreign owners. Legal certainty in real estate transactions provides investors with peace of mind and ensures an environment conducive to doing business. In addition, the Spanish government has implemented measures to encourage foreign investment in the real estate sector, resulting in a favorable regulatory framework and additional opportunities for investors.

The change in Mexico’s government poses uncertainties for investors, but the Spanish real estate market offers a promising outlook for those seeking to diversify their investments and find stability in a different economic and political environment. It is important for investors to carefully evaluate their options and consider the risks and opportunities in both markets before making investment decisions.

At Nolab we have understood the main concerns of Latin American investors seeking to expand their investment portfolios across borders. Contact us and talk to a specialist today. Your best investment opportunity is in Europe!