The European real estate market is facing a new cycle of transformation, marked by economic uncertainty and technological innovations. However, some key destinations within Spain, such as Madrid and the Costa del Sol, emerge as safe and attractive havens for real estate investment in 2025. The opportunities in these regions are not only due to their local characteristics, but also to the influence of global trends such as sustainability and artificial intelligence (AI), which are reshaping the industry. Discover below the main trends for real estate in the coming year 2025.

Madrid: the capital of real estate investment opportunities

Madrid, Spain’s economic and cultural center, continues to consolidate its position as an attractive destination for investors seeking security, stability and long-term growth. The city offers a robust real estate market, with high demand in both the residential and commercial sectors. Properties in strategic areas such as downtown and well-connected areas are highly profitable, as the capital city is home to a dynamic and diversified economy. This stability, together with a transparent legal environment that protects property rights, provides investors with an unbeatable framework of confidence.

In addition, Madrid’s ongoing urban transformation, driven by infrastructure modernization and sustainability, is creating new opportunities. Rehabilitation projects and strategies such as “turnkey” or “flipping” are gaining popularity, offering profitability for both local and international investors. Madrid is undoubtedly a market that combines economic growth, ever-expanding housing demand and legal certainty, making it one of the most promising European capitals for 2025.

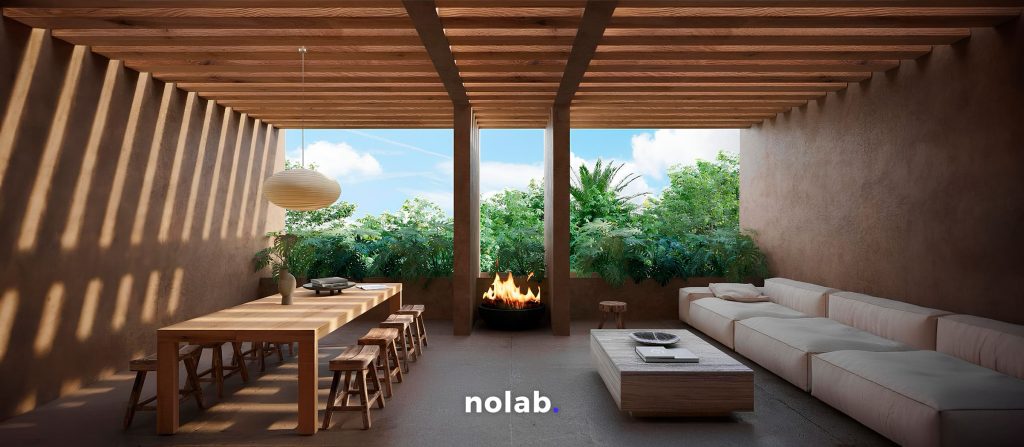

The Costa del Sol: a European paradise to invest and live in

With over 325 days of sunshine a year and a Mediterranean lifestyle that blends luxury and relaxation, the Costa del Sol is a magnet for international investors. Destinations such as Marbella, Estepona and Malaga have experienced a significant increase in the development of high-end properties, which has attracted investors with high purchasing power in search of second homes or vacation properties. Demand for short-term rentals has also grown exponentially, increasing by 14% to 18% in 2023 alone, driven by the steady flow of tourists choosing the region for their vacations.

Investment in vacation properties on the Costa del Sol is highly lucrative, with considerable income from tourist rentals throughout the year. In addition, the region continues to expand its infrastructure, which enhances its accessibility and appreciation potential in the medium and long term. With development projects underway and a growing demand for luxury properties, the Costa del Sol remains a key focus for real estate investments in 2025, with opportunities combining sunshine, high profitability and even additional benefits such as obtaining the Golden Visa.

Trends that encourage investment in these two Spanish destinations

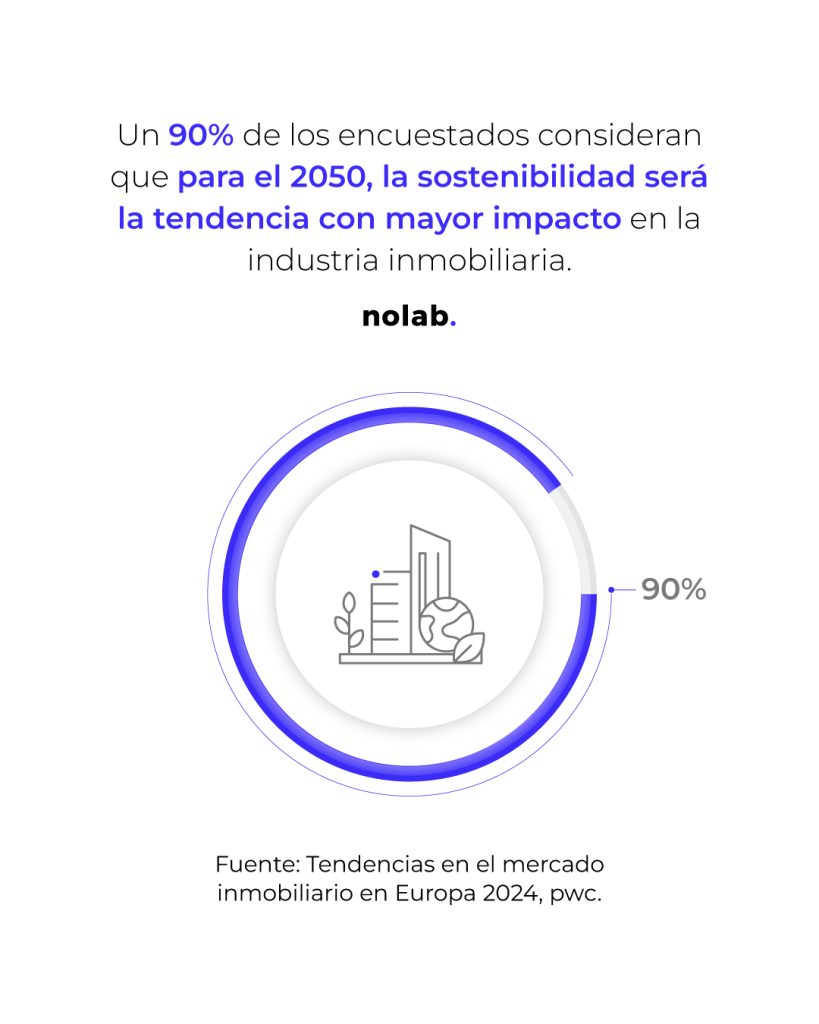

Sustainability in projects

Sustainability is no longer an option but a key requirement in the European real estate market. In Madrid and the Costa del Sol, developers are incorporating ESG (environmental, social and governance) criteria into their projects. Energy-efficient buildings, which reduce the carbon footprint and optimize the use of resources, are not only attractive to tenants, but also to investors looking for long-term resilient assets. In 2025, projects that include these elements will offer the highest returns and resale value.

Implications of artificial intelligence

AI is revolutionizing the real estate industry on multiple fronts. In Madrid, for example, artificial intelligence is helping to identify investment patterns and optimize asset management, while on the Costa del Sol, predictive models are being used to anticipate rental demand and improve the tenant experience. In addition, AI is being used for property monitoring and predictive maintenance, which minimizes costs and maximizes operational efficiency.

3. Purchase of real estate for renovation and rental

Buying properties for refurbishment has become an emerging trend in Spain, especially in Madrid and the Costa del Sol. International investors are acquiring second-hand properties with the aim of refurbishing them, not only for their personal use, but also for long and short term rentals. Renovating older properties with modern and efficient approaches can generate high returns on investment, as demand for both tourist and residential rentals continues to rise.

Practical recommendations for investing in Spain

- Know local regulations: Real estate laws in Spain can vary significantly between regions. It is essential to be well informed about taxes, rental regulations and sustainability requirements.

- Evaluate the rental market: With the growing demand for rentals, both in Madrid and on the Costa del Sol, assessing the profitability of properties earmarked for rent is a key strategy. Investing in properties that meet the expectations of today’s tenants – technology, sustainability and flexibility – can maximize returns.

- Having a trusted local team: From real estate agents to legal counsel and architects, having an experienced local team is crucial to navigating the complexities of the market and ensuring a successful investment.

- Diversify the portfolio: Combining investments in residential, commercial and tourism properties can balance risks and increase long-term stability.

Are there any risks in this type of investment?

It is true that every investment carries risk, and the real estate market is no exception. In 2025, economic volatility and factors such as interest rates and inflation could affect financing and expected returns. Also, rising construction costs, compounded by inflation and a lack of skilled labor, present challenges for new project development.

However, in established destinations such as Madrid and the Costa del Sol, the benefits far outweigh these challenges. The sustained demand for luxury properties, both for residential and tourism use, offers long-term stability, and the trends towards sustainability and modernization, although they imply certain initial expenses, also increase the value of the assets, guaranteeing a higher and more competitive return in increasingly demanding markets.

Real estate investment in Europe in 2025 is marked by opportunities in key markets such as Madrid and the Costa del Sol. Sustainability trends, the impact of artificial intelligence and the purchase of properties for refurbishment are factors that position these regions as attractive destinations. Despite economic challenges, investors with a long-term strategy and a focus on modernization and efficiency can find Spain a safe haven for growth and profitability.