Contenido de este artículo 🧭

ToggleOver the last few years, investing in real estate has become one of the best practices for many people around the world to protect their wealth, and at the same time, earn profits over time. Even so, investing in real estate in the right way and without risk is not an easy task. That is why today we will give you 7 tips to invest in real estate in 2023 .

Why invest in real estate?

Investing in real estate has become a financial defense mechanism, where the wealth of millions of people has found a refuge to overcome the effects of inflation, either in their home country or in some other part of the world.

This type of investment can bring great benefits immediately, however, in the medium and long term is where the most attractive returns are found.

3 main benefits why you should invest in real estate

- It is a business model that does not demand 100% of your time: while every business requires your attention to function optimally, real estate needs care and maintenance that can easily last for months or years, so the work you will have to do is minimal.

- The return on investment is higher compared to other types of investments: this point must be taken with care, since the return on investment sometimes depends on external factors such as location, surrounding projects and general urban planning. These factors also come into play if you are looking to invest in a property for capital appreciation returns, monthly rentals, or a remodel-and-sell model.

- You diversify your sources of income and financial assets: although having other types of investments or businesses also implies having another source of income, real estate has characteristics that make it very difficult for it to lose value over time. So your money will be much safer.

How can you start investing?

Real estate investment encompasses several very interesting modalities that can easily be adapted to different pockets. At present, there are highly attractive financing plans (issued by official financial institutions) for all types of public.

In that sense, you can start by investigating options to process a financial credit that allows you to acquire your first real estate, whether it is a house, apartment, commercial property or land. Remember to check the interest rate, as there are still many variable rate models and this can trigger unfavorable events for your payment plan.

If you, on the other hand, already have enough capital to start acquiring real estate, it is necessary that you define the purpose you will give to the property, that is to say, if you plan to live in it, restore it or rent it. With this basic step you will get more clarity about the time and the amount of profit you will get with a property.

Fractional investment and crowdfunding

In a third scenario, there is also a shared investment modality. This point could be divided into two: fractional ownership and crowdfunding.

Previously we told you in detail about the main characteristics to consider when investing in a fractional ownership propertyin short, a fractional property is one where several people purchase a residential property for the purpose of using it for only a few weeks of the year. In this business model, the costs, rights and benefits of a property are divided among several investors.

On the other hand, the crowdfunding is an investment concept where you contribute a minimum amount to the project (usually tens or hundreds of investors in the same project). And while the returns are lower versus the fractional type of investment, this is a great alternative for the tightest of pockets. There are several platforms where groups of developers upload their projects and you can easily log in, find out more about them and decide whether you want to participate or not.

What types of real estate are there?

- Residences: properties for private and individual use.

- Commercial: hotels, shopping malls, offices, parking lots, condominiums, factories, warehouses and more.

- Land: places where there are no buildings and what you are paying for is the value of the land.

7 tips for investing in real estate

1. Leave emotions aside.

Emotions play a fundamental role when selling a property, even more so if you have lived iconic moments of your life in its facilities. Keep in mind that real estate is a business possession that, if you play your cards right, will bring you better results for your life.

2. Explore the best destinations to invest in and the benefits beyond the economic.

We have previously provided recommendations on the best investment destinations on the Mexican coasts as well as in which section of Polanco you should buy an apartment. In both cases, the most profitable real estate investments are those that you can make in strategic points with a high rate of economic growth.

Speaking specifically of Spain and the United States, with your real estate investment you may be eligible for other benefits such as the Golden Visa or be part of the EB-5 Program. In both cases, these benefits allow you and your immediate family to obtain a resident visa in both countries and have free transit through other countries.

3. Consider alliances with a group of investors.

Fractional purchasing is ideal for two main reasons: you enjoy the rights and benefits of a property in a paradisiacal destination for certain weeks of the year, and in the future, if you wish, you can sell the fraction of the property that corresponds to you and obtain returns thanks to the capital gain.

The other main reason is that you also share the rights of owning the property, such as the payment of taxes and general maintenance .

Remember that you do not necessarily have to participate with unknown investors, you and a group of friends or family members can organize and acquire a real estate that will bring you great benefits for tomorrow.

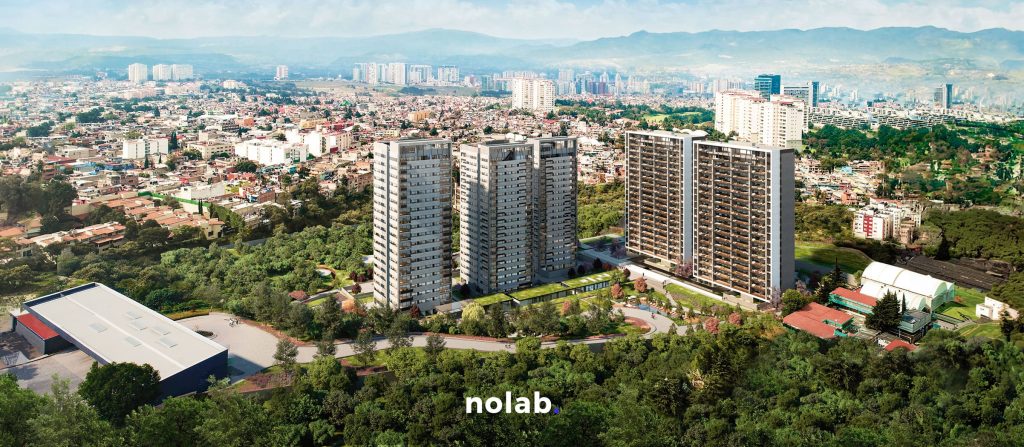

4. Purchase pre-sale properties

Previously we told you about everything you need to know when buying a pre-sale property . This type of purchase is highly attractive since the value you pay for a property under development can sometimes be up to 30% less than its final value .

In order to buy in presale successfully, you must be aware of the waiting time, since in most cases, this time can range from 6 to 18 months. Although there are also projects that can take up to 24 months. This depends on the characteristics of the construction, location, and people involved.

5. Consult with specialists in the area

Before investing in any type of project, make sure that the people to whom you are going to entrust your investment belong to serious and experienced companies or real estate agents in the area. This way you will be able to take advantage of the knowledge that you do not possess and avoid misunderstandings.

The best thing you can do to trust the seriousness of such an organization is: look for references in social networks, access their website, verify the type of projects they currently handle and have had in the past, talk directly to a specialized consultant and/or a project manager, as well as ask friends or acquaintances for references about them.

6. Evaluates the characteristics of the projects

A simple but effective example is the following: if you find a 3-bedroom project in some of the best streets to invest in Polanco, this is a sign that your investment will pay off, since 3-bedroom apartments in this area are very scarce .

Another example would be the development’s amenities. In areas such as the Condesa and Roma neighborhoods in CDMX, there are few real estate developments that integrate cafeterias, restaurants, swimming pools, work spaces, daycare centers, common gardens, etc. So if you find a project with these qualities in the area, there is no doubt that in the future it will be highly desired by people.

Here also comes into play the type of construction (individual residence or apartments), quality of construction, possibility of redesigning the interiors in some decades and the connectivity with strategic avenues or the possibility of making your life on foot. These elements are becoming increasingly relevant to the final decision of buyers.

7. Take into account the price per square meter of the area.

When buying a property in a strategic destination, you should check the value per square meter in the area. This way you will avoid falling into prices that are above average and you will be able to invest your money better. For example: the average price per M2 in Polanco , on any of the three most desirable streets to live, ranges from $130,000 MXN to $150,000 MXN. These three streets are: Rubén Darío, Campos Elíseos and Tres Picos.

We hope you find this information useful to invest your money wisely and obtain the best returns over time. Remember that in Nolab we have the best luxury residential projects in Mexico, the United States and Spain. Contact us at and discover the maximum potential of your investment.