The world turned its gaze to personal finance, after spending more than two years living through a global pandemic. Millions of people became unemployed or had to move their offices home. This made having financial health and thinking about investing more important than traveling or shopping. This is how investments started to be in vogue, beyond economists, traders and financiers. But is it true that buying an apartment is better than investing in trading operations? In this context, today we bring you 5 tips for investing in real estate in Mexico.

Buying an apartment (in a high appreciation zone) offers a high return on investment. While it is true that high-risk investments can exceed this return, they also imply the possibility of suffering a greater loss, due to their volatility. Let’s say that if you choose to make high-risk investments you will be relying on millions of external factors including a bit of luck.

If what you want is to have a long term patrimony to live in a stable way. Your best bet is to buy real estate. But, first you must make an analysis of your finances and your ability to pay.

In order to acquire real estate for cash, you should consider that this expense does not significantly affect your short and medium term plans.

In the case of a credit purchase, CONDUSEF (The National Commission for the Protection and Defense of Financial Services Users) says that to determine your payment capacity, the first step is to follow this formula:

Monthly income – Monthly expenses = Ability to pay

This ability to pay should cover mortgage payments, tax payments and expenses. If you currently pay rent, you can substitute this expense for the mortgage payment, but you should not forget the extra expenses such as improvements, contingencies, insurance, among others already mentioned. This is why it is advisable to look for a mortgage that is lower than the rent you are paying .

1. CONDUSEF recommends waiting if:

1.- Your debts are greater than 30% of your income.

2.- Your savings are not enough to cover the down payment or initial expenses.

3.- Your fixed income is uncertain or highly variable.

2. What will be the costs associated with my purchase?

There is a rule – endorsed by specialized financiers – called the 5% rule. Experts estimate that the annual expenses associated with the purchase of an apartment correspond to 5% of the total cost of the real estate.

This 5% is divided as follows: the first 2% is allocated to expenses such as maintenance, contingencies and insurance. Remember that this asset is yours and you must take care of it and keep it in the best condition and always insured. Also note that most developments ask for a monthly fee to take care of common areas.

3. The other 3% goes to interest payments and opportunity cost.

For example, an apartment costing $5,000,000 pesos would have an annual cost for associated expenses of $250,000 pesos. Approximately 20,000 pesos per month. This number must be less than your monthly rental expenses in order for it to be convenient for you.

Now for this rule to be valid you must consider that the interest should not be greater than the increase in the value of your property, i.e. if you pay 9% annual interest your apartment must increase at least 9% in value each year. You can visit CONDUSEF ‘s comparative table to get a clear idea of mortgage interest rates.

One way we recommend as experts to know how long it will take you to recover your investment is to calculate the ROI.

How do I calculate the ROI of a real estate property?

The Return on Investment ( ROI ) is the metric that helps to calculate the time it will take to recover the investment and -even better- it will indicate if the purchase we are thinking of making is profitable.

This calculation requires several key numbers, the first one to be defined is the profit (the monthly profit we will obtain from the purchase of the real estate). In order to calculate the monthly profit we recommend the following formula:

Monthly income – purchase expenses= Monthly Income

Purchase costs are mortgage payments, maintenance and tax payments.

That is, if you receive a monthly rent of $50,000.00 pesos and the sum of your expenses is $35,000.00 pesos. Your monthly profit is $15,000.00 pesos per month.

$50,000.00 – $35,000.00 = $15,000.00 per month.

Monthly income Monthly expenses Monthly income

In the case of a cash purchase, the mortgage expense is subtracted from the monthly expenses.

That’s it, we now have the key number to calculate the ROI. The formula for this calculation is:

Down payment / monthly profit = ROI

For example, if your down payment was half a million pesos and your profit was fifteen thousand pesos:

$500,000.00 / $15,000 = 33.33 months

Down payment / monthly profit = ROI

In the case of properties acquired in cash, the formula to be used is as follows:

Total investment / monthly profit = ROI

For example, if the total investment was 5 million pesos and the monthly profit is 25 thousand pesos:

$5,000,000 / $25,000 = 200 months

5. Why is the ROI different in case of credit or cash?

This is because it is calculated based on the value of your initial outlay. In the case of credit you have such support, but you continue with a long-term commitment and in the case of cash payment the initial disbursement is high.

Now, it is important that you consider an extra fact, the increase in rent. You should consider that either due to demand or inflation it is normal for the rent of a property to increase every year or at each renewal of a lease. And that it ranges between 3 and 5% in the event of inflation and cannot exceed 10% without prior notice. The latter because article 2448-J of the Mexico City Civil Code protects the lessor from an unreasonable increase.

Now, you are the owner of privileged information that few use when buying an apartment. Remember that these data are only examples and always try to make a detailed analysis of the purchase, area and appreciation. As well as secondary risks, such as the time the apartments remain unrented or surrounding risks. What you should not forget is that experts recommend investing in real estate in the CDMX because of its high profitability and low risk .

According to the 2020 Home Price Index, the price of homes with median-residential value had an increase of 5.6%. This means that, on average, the price of houses in this period rose even though, according to the estimate of the National Institute of Statistics and Geography (INEGI), the GDP decreased 4.5% in the last four-month period.

What can we conclude?

The purchase of an apartment is opportune if you have the ambition to increase your income through secure investments and meet the following 10 points:

- Your ability to pay is adequate.

- By applying the 5% rule you get post-purchase benefits.

- ROI meets your financial health.

- You are looking to invest month to month in the purchase of real estate.

- You know that saving every month will make you aware of your expenses.

- Leaving the money still under the mattress sounds anachronistic to you.

- You think it is a good idea to invest in an asset that maintains its value above inflation year after year.

- You aspire to have an asset that you can dispose of for sale at any time.

- You want financial and emotional stability.

- You aspire to increase your income through secure investments.

Remember that your purchase should be congruent with your income and expectations of a quality life .

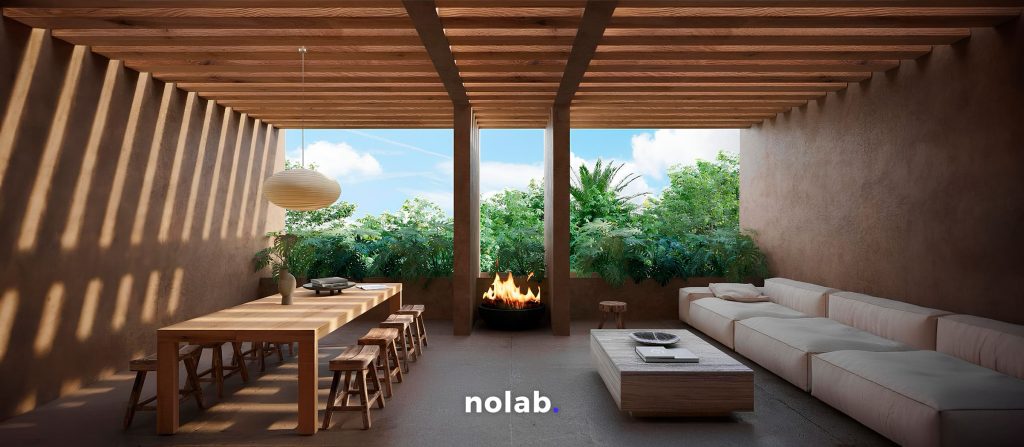

We recommend these apartments with great value and style.